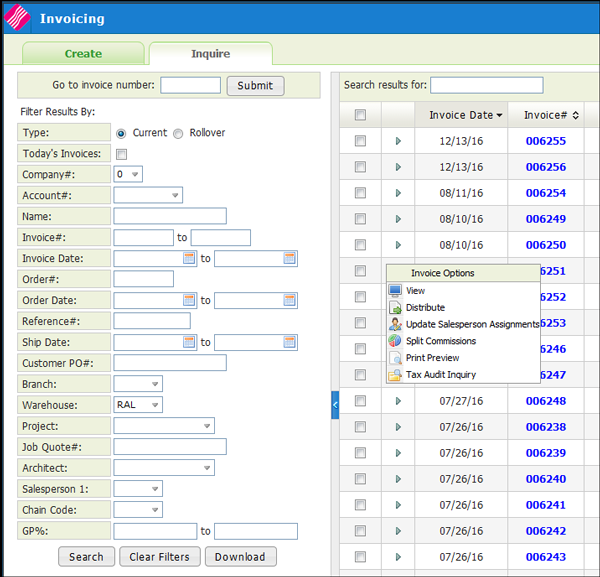

Invoice Options

On the Inquire tab, click the option arrow to the left of an invoice to display the Invoice Options box.

Update Salesperson Assignments

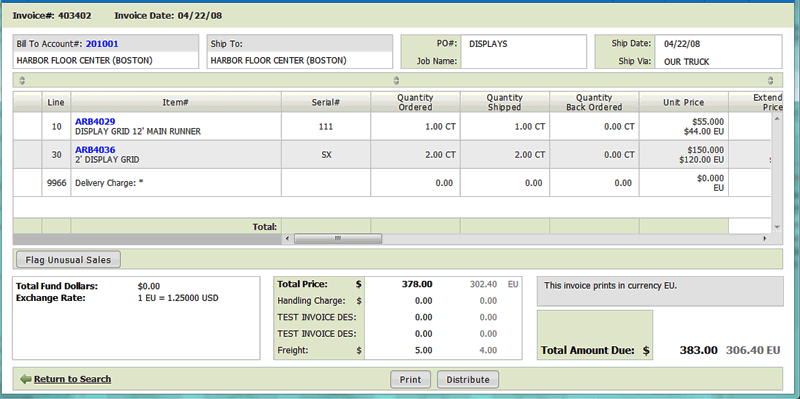

View

Displays the details behind the invoice.

Notes:

- Rolled good UMs (i.e. SY) are also display in feet and inches.

- The ability to view cost information is controlled by the setting Allow Costs To Show On Orders on the Control User File Maintenance screen (NAV 5 option "U").

Use the scroll bar in the lower right-hand corner to access additional information.

Distribute

Click the Distribute option to print or to use Output Distribution System (ODS) to fax and/or email the invoice. For detailed information , refer to Invoice Options.

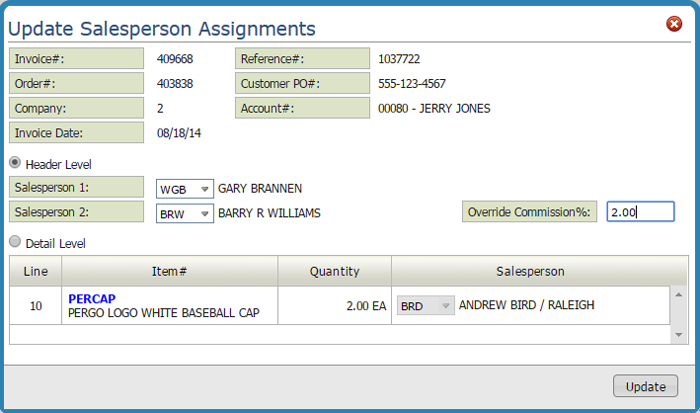

Update Salesperson Assignments

This option enables you to update both the secondary and primary salespersons on an order or invoice, even after it is invoiced.

This option displays the primary (header) salesperson and secondary salesperson assigned to the selected invoice. These fields will be blank if no salespeople are currently assigned to the invoice, or if the salespeople are assigned to detail lines, but not at "header level".

You may change the primary (header) salesperson, but you cannot use the program to remove the primary salesperson. You can change or remove the secondary salesperson and/or their commission percentage.

You can not alter the commission percentage of the primary salesperson from this screen. The commission for primary salespeople is maintained using the Base Commissions and Commission Exceptions files.

All changes on this screen are documented automatically on the Invoice Notepad. The notepad shows the previous and new salespeople. If a commission override % is keyed or changed, the notepad indicates that a commission % was changed, but does not show the %, as that is not public information.

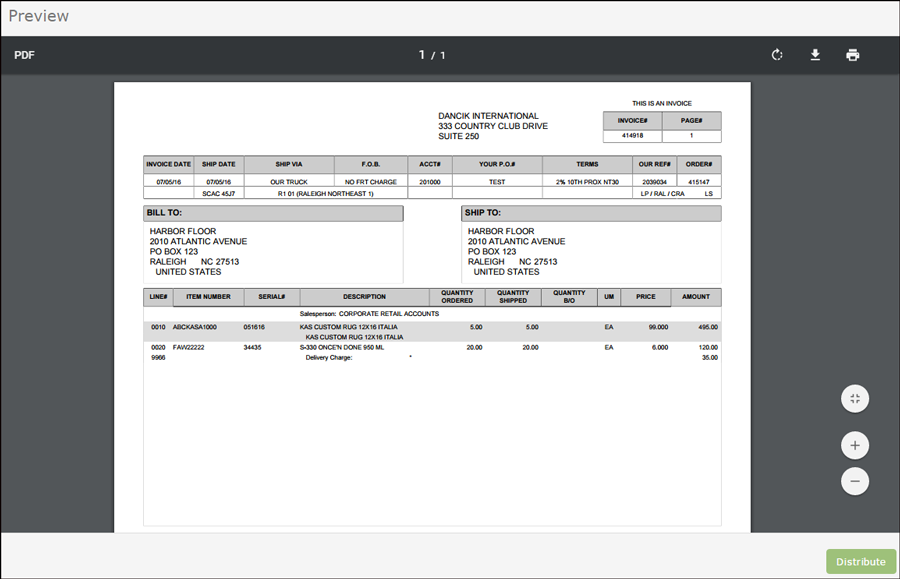

Print Preview

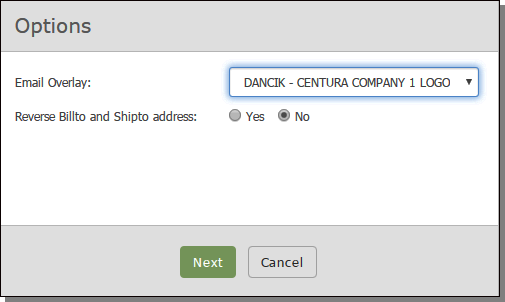

The first window allows you to format the invoice using an invoice overlay.

Click Next to generate a PDF of the invoice.

Use the options in the upper right hand corner to rotate, download, and/or print the PDF invoice.

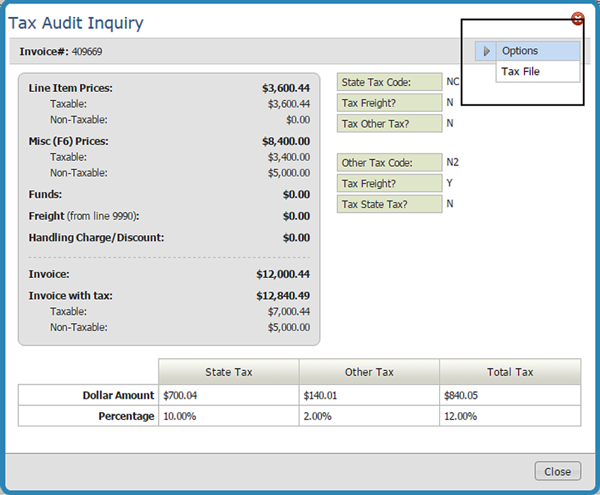

Tax Audit Inquiry

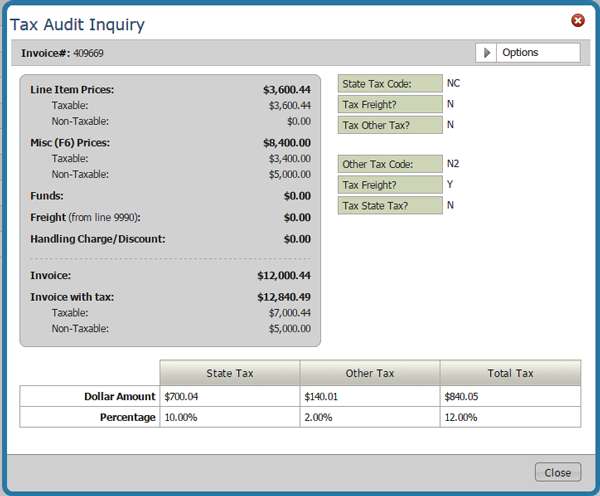

This functionality, available also in the green screen via menu option SYS 909, displays the breakdown of taxable versus non-taxable amounts on an invoice. The taxable and non-taxable amounts are shown as originally calculated. This keeps the historical information accurate and not based on tax rates, which may have changed since the invoice was generated.

This window is meant to be used for research, in anticipation of a tax audit. It enables you to see how your system tax options are set, as well a what taxes were actually charged on any invoice.

This first part of the screen shows the tax codes applicable to the invoice and system related settings for charging tax. These fields are the tax codes assigned to the invoice, but do not necessarily represent the description or settings that were in the Tax file at the time the invoice was generated. They are simply the values currently in the Tax file.

The second part of the screen breaks down the taxable and non-taxable charges pertaining to this invoice, regardless of current tax rates.

Access the Tax File from the Tax Audit Inquiry window

The File Management Tax File can be accessed from within the Tax Audit window. Use the Tax File to update or edit the tax codes. These changes do not effect invoices that are already created.